Florida’s real estate market has been a hot topic lately, with many wondering: Is the Florida real estate market slowing down? At Global Florida Realty, we’ve been closely monitoring the trends and shifts in the Sunshine State’s property landscape.

Recent data suggests a cooling off period may be underway, influenced by factors like rising interest rates and economic uncertainties. In this post, we’ll explore the current state of Florida’s real estate market and what it means for buyers and sellers alike.

Florida’s Real Estate Market Shifts

Florida’s real estate landscape undergoes significant changes. In major cities like Miami, Orlando, and Tampa, we observe a notable shift in sales volume and prices. According to data from Florida Realtors, closed sales of existing single-family homes increased by 5.2% year-over-year in July 2024. This uptick suggests a resurgence in buyer interest, particularly for single-family properties.

Price Trends Across Florida

The statewide median price for single-family existing homes reached $416,990 in July 2024, a slight 0.5% increase from the previous year. This modest growth indicates a stabilization in the market after years of rapid appreciation. Interestingly, condo prices have taken a different trajectory, decreasing by 1.3% year-over-year to a median price of $315,000. These figures highlight the varying dynamics between property types and locations within Florida.

Market Conditions: Then and Now

Current market conditions contrast starkly with previous years. Over the past five years, Florida home values skyrocketed by approximately 80%. However, this growth rate now decelerates. The market transitions from a seller’s paradise to a more balanced environment. In June 2024, 32,836 homes were sold, down from 38,387 in the previous year. This trend suggests a market correction and increased negotiation power for buyers.

Interest Rates and Buyer Behavior

Rising interest rates significantly impact buyer demand. Mortgage rates climbed from around 3% in early 2023 to over 7% in recent months. This dramatic increase affects affordability and cools buyer enthusiasm. As a result, we see changes in buyer behavior. Some potential homeowners delay purchases, while others adjust their expectations or look at different property types or locations.

Shifting Preferences in Property Types

We observe a shift in preferences towards single-family homes over condos in the current market scenario. This trend aligns with the statewide data and reflects changing priorities among buyers in the wake of the pandemic and economic uncertainties.

The cooling market presents both challenges and opportunities. For buyers, the increased inventory and less competitive bidding scenarios could lead to more favorable conditions. Sellers may need to adjust their expectations and pricing strategies to attract buyers in this evolving market.

As we move forward, it’s important to understand the factors contributing to this market slowdown. Let’s examine the increased inventory levels, economic uncertainties, and shifting buyer preferences that play a role in shaping Florida’s current real estate landscape.

Why Is Florida’s Real Estate Market Slowing?

Florida’s real estate market experiences a notable slowdown, and several key factors contribute to this shift. Understanding these elements proves essential for buyers and sellers who navigate the current market landscape.

Inventory Surge Across Florida

One of the most significant changes in Florida’s real estate market is the substantial increase in inventory levels. In March 2024, Florida saw a 57% increase in inventory year over year on Realtor.com (the largest inventory increase in the United States). This surge in available properties shifts the market dynamics, giving buyers more options and potentially more negotiating power.

For example, in June 2024, the inventory of homes for sale increased by 40.1% compared to the previous year, with approximately 198,000 properties listed. This influx of inventory appears particularly noticeable in areas like Seminole and Orange counties, where the number of condos for sale jumped from 890 to 2,088 in just one month.

Economic Uncertainties and Affordability Concerns

Economic factors play a significant role in the current market slowdown. The combination of high mortgage rates, rising property taxes, and expensive homeowner’s insurance impacts affordability across the state. Florida homeowners now face the nation’s highest homeowners insurance premiums due to risks from hurricanes and floods, adding to the overall cost of homeownership.

These economic pressures reflect in recent market data. In June 2024, 30.9% of homes experienced price drops (up from 26% in 2023). This trend signifies a shift towards a buyer’s market, with sellers adjusting their expectations to meet current economic realities.

Post-Pandemic Shift in Buyer Preferences

The aftermath of the COVID-19 pandemic leads to significant changes in buyer preferences, contributing to the market slowdown. A trend towards single-family homes over condos emerges, likely influenced by the desire for more space and privacy following lockdown experiences.

Additionally, the rise of remote work alters where people choose to live. Some buyers now look beyond traditional urban centers, exploring suburban and rural areas that offer more space and potentially lower costs. This shift cools demand in some previously hot urban markets while increasing interest in areas that were once considered less desirable.

Impact on Real Estate Professionals

The changing market dynamics affect real estate professionals as well. With fewer transactions and increased competition, agents and brokers must adapt their strategies. This situation highlights the importance of working with experienced professionals who understand the nuances of Florida’s evolving real estate landscape.

As the market continues to evolve, buyers and sellers need to stay informed about these trends. The next section will explore how these changes manifest differently across various regions of Florida, providing a more detailed picture of the state’s diverse real estate market.

Florida’s Real Estate Diversity: A Tale of Regions

Florida’s real estate market presents a complex tapestry of opportunities and challenges. Each region, from bustling coastal cities to serene inland communities, tells its own unique story. This diversity creates a varied landscape for buyers, sellers, and investors.

Coastal vs. Inland Market Dynamics

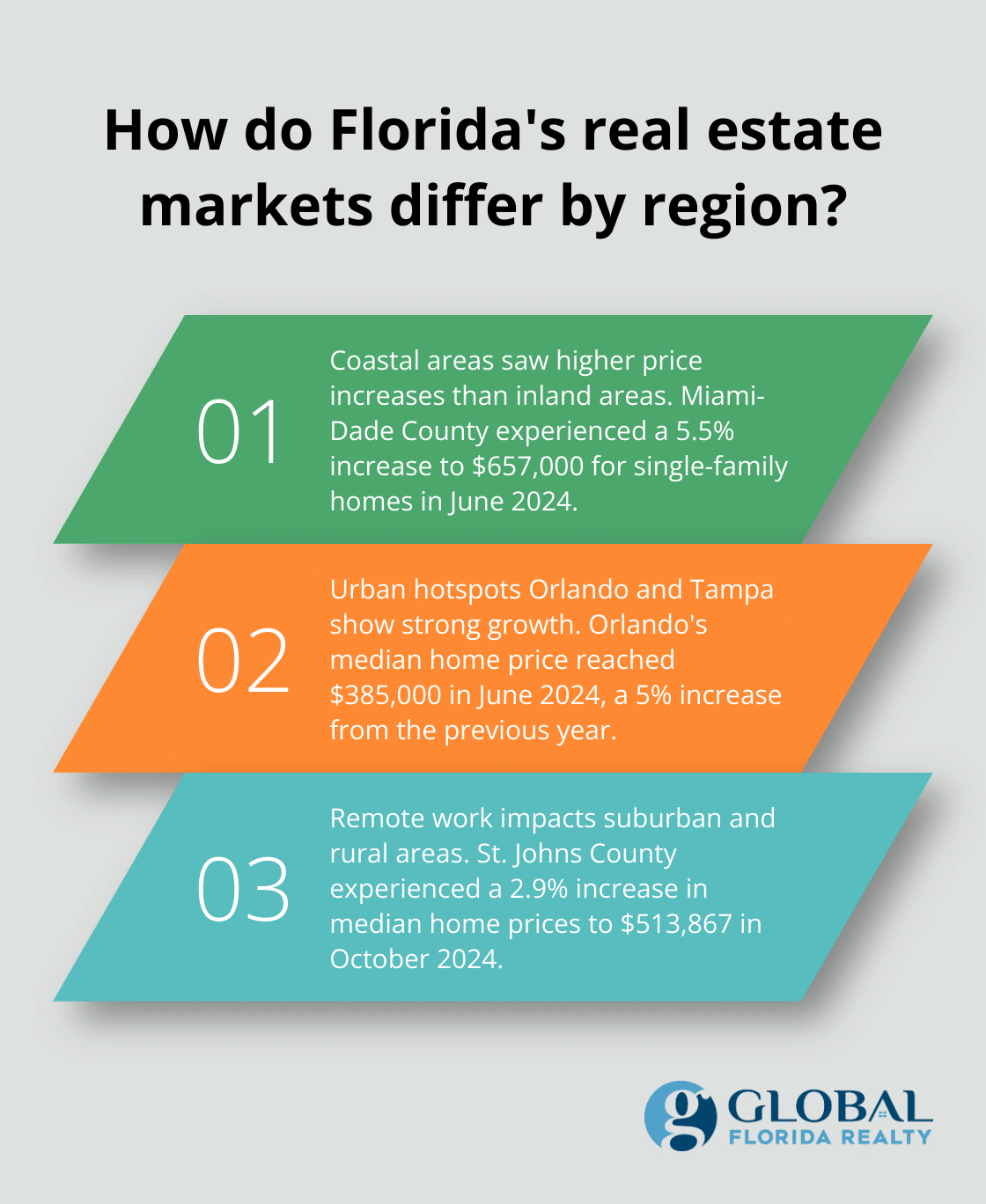

Coastal areas in Florida traditionally command higher prices due to their desirable locations and limited land availability. However, recent trends show a shift in this dynamic. Miami-Dade County experienced a 5.5% increase in median home prices to $657,000 for single-family homes in June 2024, while inland areas like Orlando saw a 2.5% increase.

This trend reflects changing buyer priorities and concerns about climate-related risks in coastal areas. Insurance costs play a significant role here. In coastal regions, homeowners insurance premiums have increased dramatically (sometimes exceeding $4,000 annually for a standard policy). Inland areas often offer more affordable insurance options, which attracts budget-conscious buyers.

Urban Hotspots: Orlando and Tampa

Orlando and Tampa remain high-demand areas, but for different reasons. Orlando’s real estate market thrives on its strong tourism industry and growing tech sector. The median home price in Orlando reached $385,000 in June 2024, a 5% increase from the previous year. This growth outpaces many other Florida markets, indicating sustained demand.

Tampa attracts buyers with its mix of urban amenities and coastal living. The city experienced a 3.8% increase in median home prices, reaching $412,000 in June 2024. However, Tampa’s market also shows signs of cooling, with homes spending an average of 22 days on the market (up from 14 days the previous year).

Remote Work’s Impact on Suburban and Rural Areas

The rise of remote work has reshaped Florida’s real estate landscape. Suburbs and rural areas once considered too far from job centers now see high demand. St. Johns County, south of Jacksonville, experienced a 2.9% increase in median home prices to $513,867 in October 2024.

This trend extends to smaller towns and rural areas. Ocala, known for its horse farms and natural springs, saw a 6.5% increase in median home prices. These areas offer larger properties at lower prices compared to urban centers, which appeals to remote workers seeking more space and a quieter lifestyle.

Many clients now prioritize home offices and high-speed internet connectivity over proximity to urban centers. This change in priorities opens up new possibilities for buyers and presents unique opportunities for sellers in previously overlooked areas.

Understanding these regional variations proves essential for making informed decisions in Florida’s evolving real estate market. Whether you plan to buy, sell, or invest, recognizing the unique factors that shape each local market will help you navigate this diverse landscape.

Final Thoughts

Florida’s real estate market shows signs of slowing down, but the situation varies across regions and property types. The surge in inventory levels and economic factors like rising interest rates have tempered the rapid appreciation seen in recent years. This changing market presents unique opportunities for both buyers and sellers, with increased choices and potential for negotiation.

Real estate remains inherently local, and what applies to one area might not hold true for another. This diversity underscores the importance of working with experienced professionals who understand the nuances of Florida’s varied real estate landscape. At Global Florida Realty, we use our expertise to guide clients through these market shifts.

As Florida’s real estate market continues to adapt, staying informed will help you make sound decisions. The current market may cool in some aspects, but it also opens doors to new possibilities for those ready to seize them. Our team’s deep market knowledge and personalized approach can help you navigate this evolving landscape with confidence.