Orlando’s real estate market offers exciting opportunities for investors. At Global Florida Realty, we’ve identified the best areas in Orlando to buy rental property.

From bustling urban centers to family-friendly communities, each neighborhood presents unique advantages. Let’s explore the top Orlando areas that promise strong returns on your rental property investment.

Why Downtown Orlando Attracts Young Professionals

Thriving Job Market Fuels Rental Demand

Downtown Orlando has transformed into a powerhouse for young professionals seeking dynamic urban living. The area’s appeal stems from its perfect blend of career opportunities and lifestyle amenities, making it a top choice for rental property investments.

Downtown Orlando’s robust job market continues to expand. The construction sector gained 4,200 jobs, while education and health services increased by 3,500 jobs in October 2024. This job growth directly translates to increased demand for rental properties, as young professionals prefer to live close to their workplaces.

Entertainment and Lifestyle Options Enhance Property Appeal

Downtown Orlando offers more than just career opportunities – it’s a lifestyle hub. The area packs over 100 restaurants, bars, and entertainment venues within walking distance. The Dr. Phillips Center for the Performing Arts hosts over 300 shows annually, while the Amway Center brings in major concerts and sporting events. These amenities make downtown properties highly attractive to renters who value experiences and convenience.

High Rental Yields Attract Savvy Investors

The combination of strong demand and attractive amenities results in impressive rental yields for property investors. As of January 2025, average rents in downtown Orlando have reached $2,300 for a one-bedroom apartment (a 7% year-over-year increase). With occupancy rates hovering around 95%, investors can expect consistent cash flow from their properties.

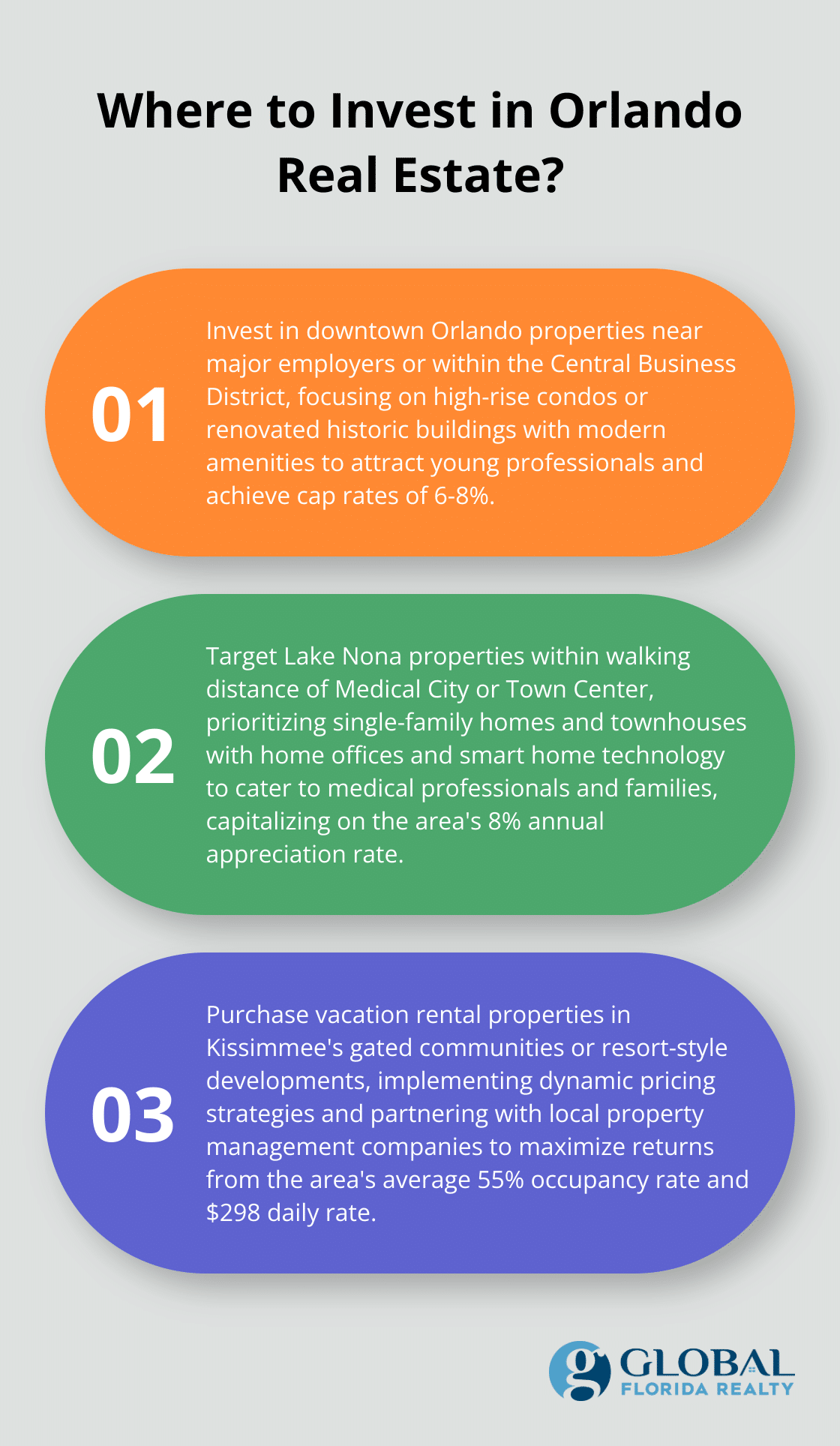

The downtown Orlando market has seen a surge in interest for rental properties. Recent data shows that well-located units can achieve cap rates of 6-8%, significantly higher than many other urban markets. Investors looking to capitalize on this trend should focus on properties within walking distance of major employers and entertainment districts.

Strategic Investment Opportunities

For those considering downtown Orlando for rental property investment, several factors warrant attention:

- Location: Properties near major employers or within the Central Business District tend to command higher rents and experience lower vacancy rates.

- Property Type: High-rise condos and renovated historic buildings are particularly popular among young professionals.

- Amenities: Units with modern features (e.g., smart home technology, fitness centers, and co-working spaces) often justify premium rents.

- Transportation: Properties near public transit options or with dedicated parking can be especially attractive in the urban core.

As we move our focus to Lake Nona, we’ll explore how this planned community offers a different, yet equally compelling, investment opportunity in the Orlando area.

Lake Nona: A Booming Real Estate Market for Rental Property Investment

Lake Nona has quickly become one of Orlando’s most promising areas for rental property investment. This master-planned community, covering 17 square miles, has transformed from undeveloped land into a thriving center of innovation, healthcare, and education.

Medical City Fuels Rental Demand

The cornerstone of Lake Nona’s growth is Medical City, a 650-acre health and life sciences park. This complex houses several major institutions, including the University of Central Florida College of Medicine, Nemours Children’s Hospital, and the VA Medical Center. These facilities have created a steady influx of medical professionals, researchers, and students who need quality housing.

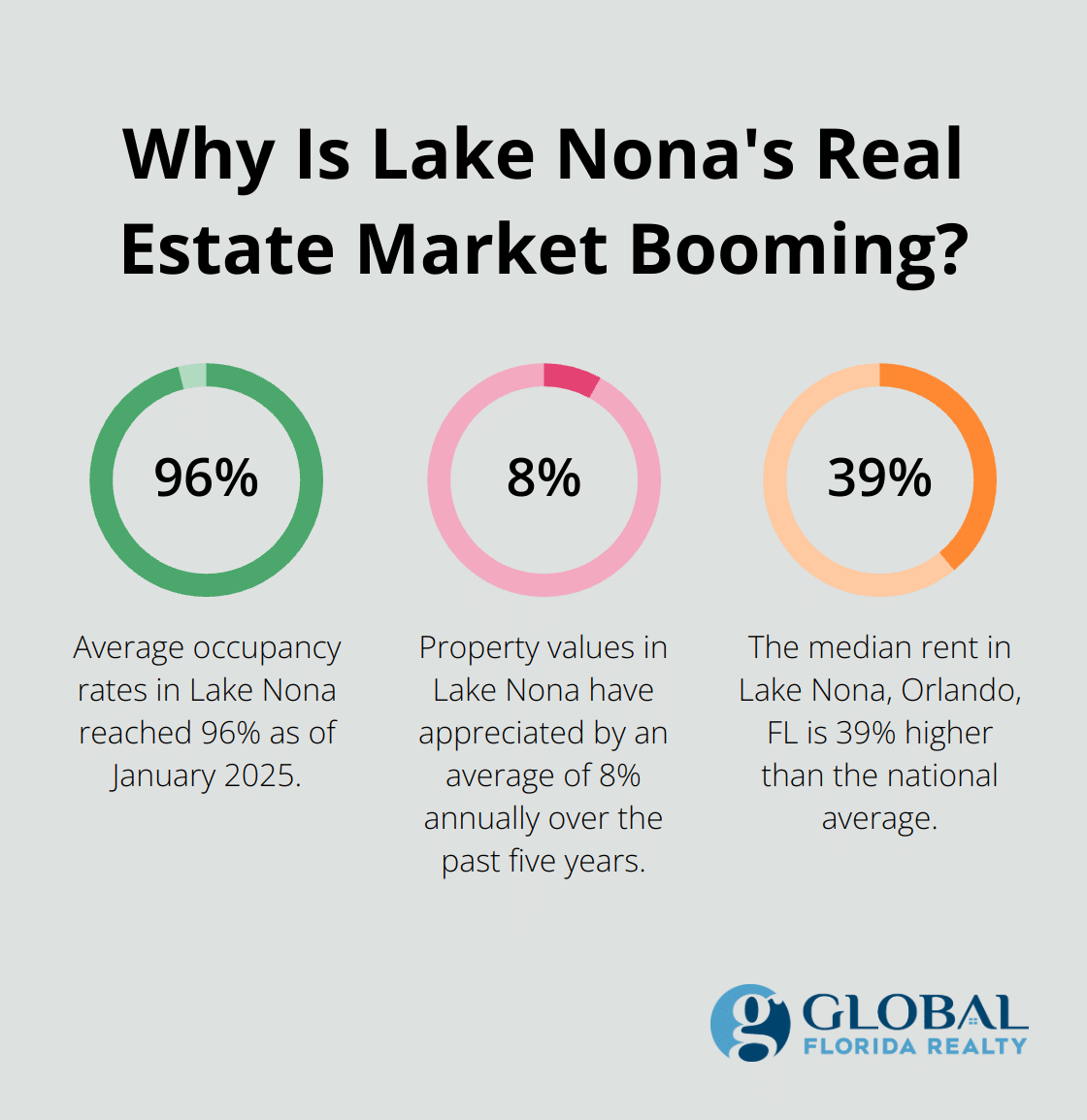

The college of medicine alone is expected to create more than 30,000 local jobs and have a ten-year economic impact of $7.6 billion. This concentration of employment has led to a surge in rental demand, with average occupancy rates in Lake Nona reaching 96% as of January 2025.

Tech-Forward Community Attracts Professionals

Lake Nona’s commitment to innovation extends beyond healthcare. The community has embraced smart city technology, offering residents amenities like community-wide Wi-Fi, autonomous shuttles, and smart home integration. These features appeal particularly to tech-savvy professionals and families.

The KPMG Lakehouse, a 55-acre training facility, brings thousands of employees annually for professional development. This influx of short-term visitors creates opportunities for furnished rental properties and corporate housing investments.

Impressive Appreciation and Rental Yields

Lake Nona’s real estate market has shown remarkable growth. Data from the Orlando Regional Realtor Association indicates that property values in Lake Nona have appreciated by an average of 8% annually over the past five years, outpacing many other Orlando suburbs.

Rental yields in Lake Nona are equally attractive. As of January 2025, the median rent for all bedroom counts and property types in Lake Nona, Orlando, FL is $2,621, which is 39% higher than the national average. This combination of strong appreciation and solid rental income makes Lake Nona an appealing option for long-term investors.

Strategic Investment Opportunities

Investors considering Lake Nona should focus on properties within walking distance of Medical City or the Town Center. These areas command premium rents and experience lower vacancy rates due to their proximity to major employers and amenities.

Single-family homes and townhouses are particularly in demand among medical professionals and families relocating to the area. Properties with features like home offices, smart home technology, and energy-efficient appliances can command higher rents and attract quality long-term tenants.

Lake Nona’s master plan includes further expansion of Medical City, additional corporate campuses, and new residential developments, all of which point to sustained growth in the coming years. As we shift our focus to Kissimmee, we’ll explore how this area’s proximity to major attractions creates unique opportunities for short-term vacation rentals.

Kissimmee: A Hotspot for Vacation Rental Investments

Prime Location Drives Tourist Demand

Kissimmee’s strategic position near world-famous attractions makes it a prime location for short-term vacation rental investments. Located just minutes from Walt Disney World, Universal Studios, and SeaWorld, Kissimmee attracts many visitors. While final figures for 2024 aren’t available yet, positive indicators suggest a strong year for Orlando tourism, with a potential return to pre-pandemic levels.

This constant influx of tourists results in high occupancy rates for vacation rentals. AirDNA data shows that Kissimmee short-term rentals on Airbnb and Vrbo average 55% occupancy, with a $298 daily rate and $32,919 in monthly revenue.

Diverse Property Options for Investors

Kissimmee offers a range of property types suitable for vacation rentals, from condos to single-family homes and luxury villas. Investors should focus on properties within gated communities or resort-style developments. These often include amenities like pools, fitness centers, and game rooms (which can justify higher nightly rates and attract families looking for a home-away-from-home experience).

Seasonal Trends and Revenue Potential

While Orlando’s tourism remains strong year-round, Kissimmee experiences peak seasons that investors can leverage. The highest demand typically occurs during summer months (June-August) and major holidays. During these periods, daily rates can increase compared to off-peak seasons.

Maximizing Returns through Effective Management

Proper management and marketing play a crucial role in maximizing returns on Kissimmee vacation rentals. Investors should:

- Implement dynamic pricing strategies to adjust rates based on demand

- Maintain high-quality listings with professional photos and detailed descriptions

- Provide excellent guest experiences to encourage positive reviews and repeat bookings

- Stay compliant with local regulations and obtain necessary licenses

Investment Considerations

When considering a vacation rental investment in Kissimmee, investors should:

- Research zoning laws and HOA restrictions that may impact short-term rentals

- Calculate potential returns, factoring in management fees, maintenance costs, and occupancy rates

- Consider partnering with a local property management company to handle day-to-day operations

- Explore financing options, including traditional mortgages and specialized vacation rental loans

Final Thoughts

Orlando’s real estate market presents diverse opportunities for rental property investors. Downtown Orlando, Lake Nona, and Kissimmee stand out as some of the best areas in Orlando to buy rental property, each with unique advantages. These areas attract different tenant profiles, from young professionals to medical staff and vacationers, offering various investment strategies to explore.

Investors should consider factors such as job market strength, population growth, and appreciation potential when selecting a location. It’s essential to analyze local regulations, especially for short-term rentals, and calculate potential returns based on property type and expected occupancy rates. Proper management and marketing strategies play a key role in maximizing returns on rental investments in Orlando.

Global Florida Realty understands the nuances of Orlando’s rental market and can help investors navigate the complexities of finding profitable properties. Our team offers comprehensive services, including property valuation, marketing strategies, and investment advice tailored to your goals. Contact us to learn how we can support your real estate journey in Orlando’s dynamic market.